Climate Risk Intelligence for Financial Portfolios

Integrated solutions to quantify, report, and reduce physical and transition climate and risks across lending and investment portfolios.

Risk Drivers

0

Scenario Projections

0

Integrate Portfolios

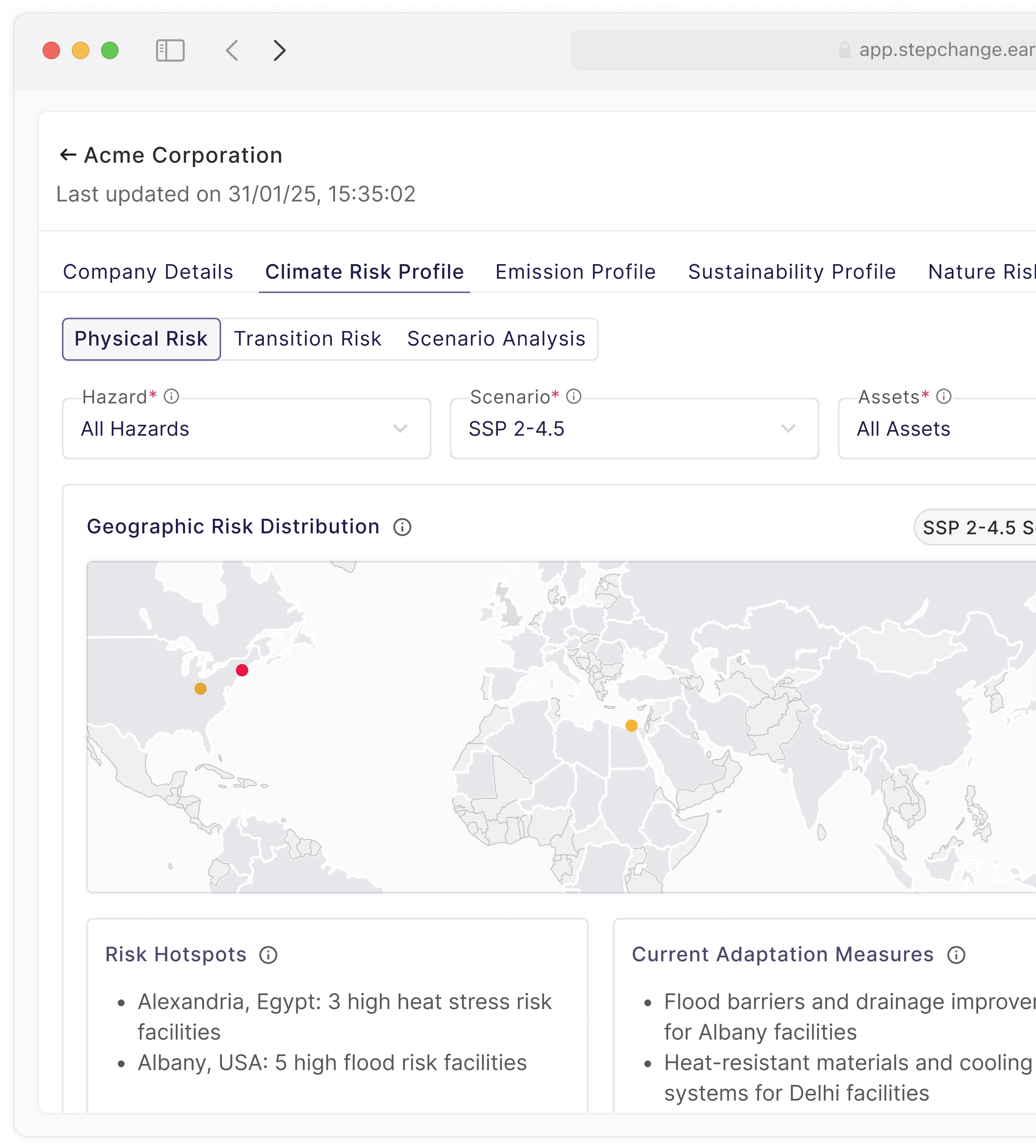

Aggregate and assimilate financial, operational and climate risk data across asset classes to assess risk exposure at the counterparty-level.

Bring Risk into Focus

Map portfolio vulnerability to physical & transition risks across a variety of transmission channels.

Quantify Risk and Impact

Calculate climate risk metrics (e.g. cVaR, PD, LGD, ECL, etc.) at different levels of granularity.

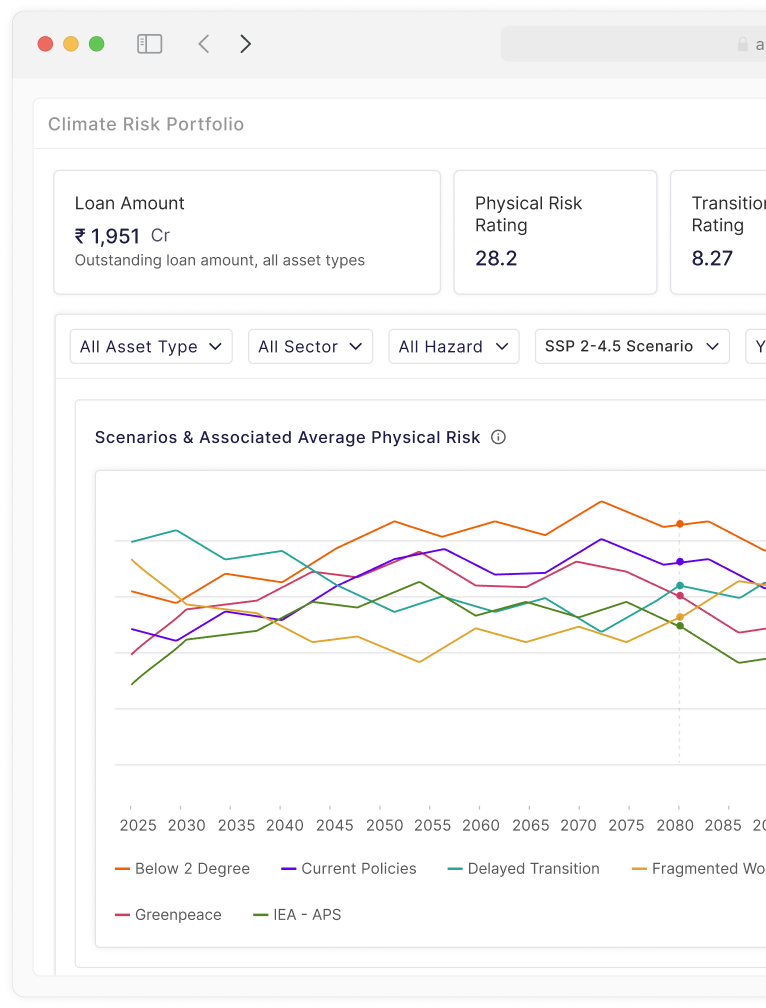

Stress Test Portfolios

Stress test portfolios across different scenarios, identify vulnerabilities and develop risk mitigation strategies.

Report With Confidence and Credibility

Generate decision-useful, audit-ready disclosures for regulators and investors by integrating seamlessly with globally recognized reporting frameworks like IFRS S2 and TCFD.

Built to Solve Targeted Pain-Points

Fragmented Risk Data

Operational, financial, and climate risk data are often incomplete and reside across different systems, limiting high-quality portfolio risk analysis.

Inadequate Stress Tests

Existing methods of stress testing do not incorporate climate risk stressors, resulting in systemically unpriced risks across the portfolio.

Idiosyncratic Specificity

Climate risk models are often over generalized and not appropriately calibrated to bank-specific risk profiles, resulting in limited utility for decision makers.

Best-in-class capabilities at an affordable price

Features

StepChange

Generic Software

Consulting Firms

Engineered for Precision, Scale and Accuracy

Granular Risk Assessments

Analyze portfolio climate risks at different levels of granularity, quantifying risk exposure and prioritizing action.

Detailed Scenario Analysis

Quantify risk exposures across a variety of key physical and transition scenarios - enabling informed business strategy.

Regulatory Readiness

Translate risk estimates into pre-defined templates that are specifically intended for regulatory disclosure.

Predictive Risk Analytics

Forecast financial risk exposure across asset classes using calibrated idiosyncratic parameters.

Client Testimonials

.svg)

Ready to Simplify Sustainability? Request a Free Assessment.

No obligations. No lock-ins. Just clarity.

StepChange in the News

.svg)

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)