Solutions

Carbon Management

ESG Intelligence

Climate & Nature Risk

Data Registry

Beta

Sector

Get started, schedule a demo or request a free assessment!

‘Nature’ and ‘biodiversity’ have until recently been relegated to the shadows of greenhouse gas emissions in the climate change conversation. However, they have now become inevitable truths owing to scientific and political effort. Understanding and mitigating negative impacts of human activity on ‘nature’ is critical to maintaining safe conditions for species to coexist. While maintaining ecological balance is a more than adequate reason to guard against negative impacts on nature, the World Economic Forum has also estimated that “approximately $44 trillion of economic value generation is moderately or highly dependent on nature”, which is more than half the global GDP. Concerted policy and innovation is required to mitigate nature related risks, and in recognition of this, almost all ESG mature economies world-over are rapidly progressing towards nature-based disclosures and solutions.

Leading disclosure related policy work on this front is the Taskforce on Nature-related Financial Disclosures (the TNFD). Modelled after its immensely successful predecessor, the Taskforce on Climate-related Financial Disclosures (the TCFD), the TNFD was announced in July, 2020 by the United Nations Environment Programme Finance Initiative (UNEP FI), the United Nations Development Programme (UNDP), the World Wildlife Fund (WWF) and Global Canopy. The TNFD was set up by an Informal Working Group (IWG), established in September 2020, comprising 74 financial institutions, regulators, corporates (including YES Bank Limited, India). In June 2021, the TNFD was formally launched in Paris with the appointment of two Co-Chairs: Elizabeth Maruma Mrema, Executive Secretary of the UN Convention on Biological Diversity, and David Craig, CEO of Refinitiv and Group Leader at LSEG.

The TNFD released pilot versions of its framework in March and June 2022, which were tested by 250 global financial institutions and corporates through an "open innovation approach". The final TNFD Recommendations were released in September 2023, providing a risk management and disclosure framework for organisations to report on nature-related risks and opportunities.

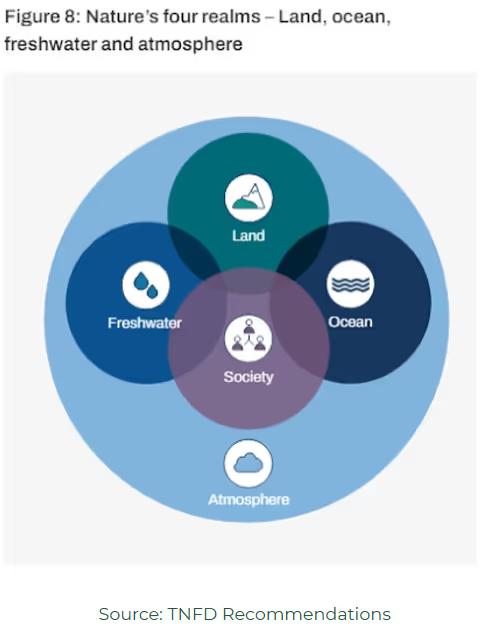

Currently, 320 enterprises (including seven Indian enterprises) representing US$4 trillion in market capitalisation have committed to making nature-related disclosures based on the TNFD’s Recommendations. ‘Nature’ in this context relates to the natural world especially including biodiversity and their interactions with each other and their environments. The ‘natural world’ has been specifically defined as comprising four realms that are critical for human existence - land, ocean, freshwater and the atmosphere.

Source: TNFD Recommendations

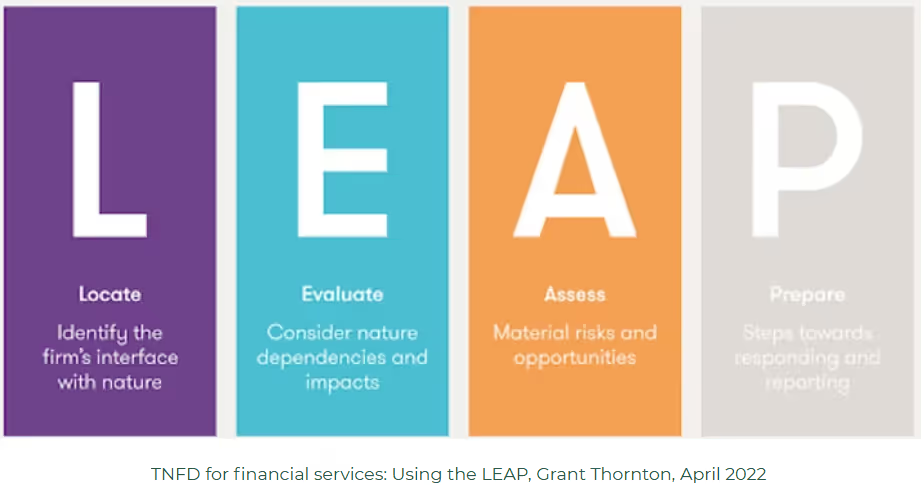

The crux of the TNFD is in the LEAP approach it has recommended:

TNFD for financial services: Using the LEAP, Grant Thornton, April 2022

Below is a detailed breakdown of each of the stages of the LEAP approach:

Locate the interfaces with nature across geographies, sectors and value chains:

Evaluate dependencies and impacts on nature: The TNFD defines nature-related ‘dependencies’ and ‘impacts’. The former relates to operational/ functional reliance of an enterprise on ecosystem services (pollination, soil quality, access to running water). The latter relates to both negative and positive changes in nature’s capacity to provide social and economic functions, caused directly, indirectly or cumulatively by an enterprise.

Enterprises will have to evaluate:

1. Relevant environmental assets and ecosystem services

2. Business process and activities at priority locations, impact and dependency on environmental assets and ecosystem services

3. Dependencies and impact: Across business at priority locations

4. Dependency analysis: Size and scale of dependencies in priority locations; Impact analysis: Size and scale of impacts in priority locations

Assess nature-related risks and opportunities to your organisation

1. Risk identification and assessment: Corresponding risks to organisation; Existing risk mitigation and management

2. Additional risk mitigation and management

3. Materiality assessment for TNFD disclosure

4. Nature-related opportunity identification and assessment

The TNFD recognises three types of interlinked risks

1. Acute: Occurrence of short-term, specific events that change the state of nature. For example, risks caused due to oil spills, forest fires, or pests affecting a harvest.

2. Chronic: Gradual changes to the state of nature. For example, a decline in crop yield due to endangerment of pollinators or poor soil quality caused by fertiliser use

The TNFD also identifies clear pathways to realise nature-related opportunities. These are defined as “activities that create positive outcomes for organisations and nature through positive impacts or mitigation of negative impacts on nature”. Broadly, the TNFD has framed these as two non-exclusive categories -

Opportunities in business performance:

Opportunities in sustainable performance:

The TNFD has introduced a ‘mitigation hierarchy’ In responding to nature-related risks and opportunities, in line with principles such as the SBTN AR3T framework:

Prepare to respond to nature-related risks and opportunities, including reporting on material nature-related issues to the primary users of financial reports and other stakeholders, aligned with the TNFD’s recommended disclosures

1. Strategy and resource allocation

2. Target setting and progress measurement

3. Disclosures in line with TNFD recommendations

4. Presentation of nature-related disclosures

Over the past year, we have conducted market research (primary research) in the EU, the UK, the US and Singapore. We have found that nature-related disclosures are increasingly taking centre-stage, with the EU being furthest ahead in this process on account of ESRS E4 (biodiversity and ecosystems) being in force. The TNFD has also published a mapping of ESRS to TNFD, demonstrating this. Similarly, GRI’s updated biodiversity standards (101) are highly compatible with the TNFD recommendations, and both organisations are collaborating to ensure interoperability and strengthening of disclosures.

Any enterprise based in the EU or having significant operations in the EU will have to take proactive measures to have their nature-related disclosures in place. Similarly, we are finding that Singapore is a leader in the ESG policy space, with high likelihood of adopting the TNFD. Globally, Japan has a strong lead in terms of TNFD adopters, with 109 being headquartered in Japan. The UK is second at 58 adopters, followed by France and Taiwan at 20 each, and the US at 17.

The TNFD has announced today that there has in fact been a 30% increase in TNFD adopters since January, with 96 organisations joining the initiative bringing the total number to 416. This represents $6 trillion in market capitalisation. The 114 financial institutions registered as adopters cumulatively represent $15.9 trillion in assets under management. Successful global adoption mirroring the TCFD seems inevitable.

The TNFD itself is incredibly proactive, with a highly informative website which serves as a self-sufficient guide to navigate the TNFD. The TNFD also organises periodic workshops and webinars, including by adopters that walk the audience through the process of compliance. Based on these, we understand that early adopters will have a significant advantage in the imminent global roll-out of the TNFD - disclosures are currently on a best-effort and continuous improvement basis, and organisations are putting the requisite data systems in place to adopt the LEAP approach. Solutions in the space are very nascent and quickly evolving - it is clear that cross-stakeholder collaboration will be critical for developing robust databases and methodologies (e.g. geographically bounded species indices, quantification of impact on these species and vice versa will require academia, governments, technology solution providers to collaborate).

.svg)